Did You Miss Eastwood Bio-Medical Canada's (CVE:EBM) Magnificent 1900% Share Price Gain?

We think that it's fair to say that the possibility of finding fantastic multi-year winners is what motivates many investors. But when you hold the right stock for the right time period, the rewards can be truly huge. For example, the Eastwood Bio-Medical Canada Inc. (CVE:EBM) share price is up a whopping 1900% in the last three years, a handsome return for long term holders. It's also good to see the share price up 13% over the last quarter.

Anyone who held for that rewarding ride would probably be keen to talk about it.

View our latest analysis for Eastwood Bio-Medical Canada

Eastwood Bio-Medical Canada wasn't profitable in the last twelve months, it is unlikely we'll see a strong correlation between its share price and its earnings per share (EPS). Arguably revenue is our next best option. When a company doesn't make profits, we'd generally expect to see good revenue growth. That's because fast revenue growth can be easily extrapolated to forecast profits, often of considerable size.

Eastwood Bio-Medical Canada's revenue trended up 42% each year over three years. That's much better than most loss-making companies. In light of this attractive revenue growth, it seems somewhat appropriate that the share price has been rocketing, boasting a gain of 171% per year, over the same period. Despite the strong run, top performers like Eastwood Bio-Medical Canada have been known to go on winning for decades. So we'd recommend you take a closer look at this one, or even put it on your watchlist.

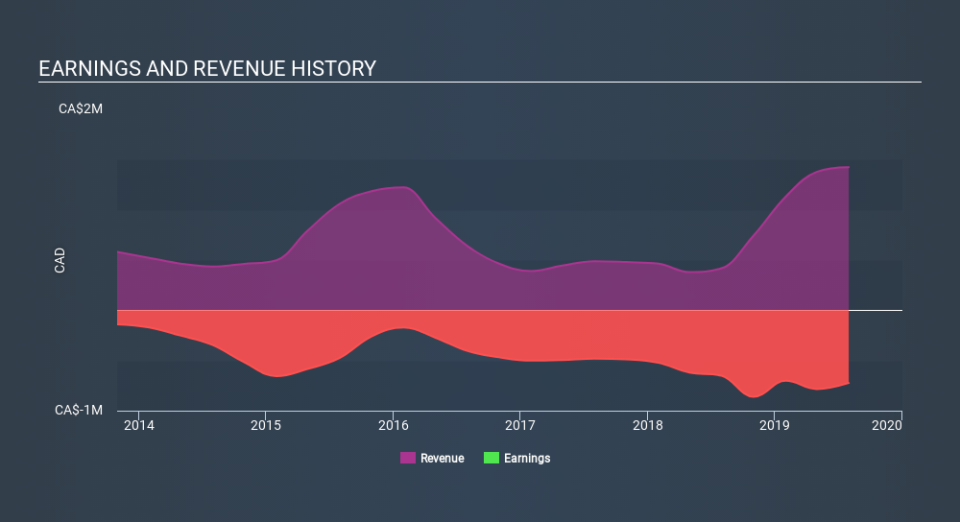

The graphic below depicts how earnings and revenue have changed over time (unveil the exact values by clicking on the image).

We're pleased to report that the CEO is remunerated more modestly than most CEOs at similarly capitalized companies. It's always worth keeping an eye on CEO pay, but a more important question is whether the company will grow earnings throughout the years. Before buying or selling a stock, we always recommend a close examination of historic growth trends, available here..

A Different Perspective

Eastwood Bio-Medical Canada shareholders are down 57% for the year, but the market itself is up 8.8%. Even the share prices of good stocks drop sometimes, but we want to see improvements in the fundamental metrics of a business, before getting too interested. Longer term investors wouldn't be so upset, since they would have made 49%, each year, over five years. It could be that the recent sell-off is an opportunity, so it may be worth checking the fundamental data for signs of a long term growth trend. I find it very interesting to look at share price over the long term as a proxy for business performance. But to truly gain insight, we need to consider other information, too. Consider for instance, the ever-present spectre of investment risk. We've identified 3 warning signs with Eastwood Bio-Medical Canada (at least 1 which is a bit concerning) , and understanding them should be part of your investment process.

If you are like me, then you will not want to miss this free list of growing companies that insiders are buying.

Please note, the market returns quoted in this article reflect the market weighted average returns of stocks that currently trade on CA exchanges.

If you spot an error that warrants correction, please contact the editor at editorial-team@simplywallst.com. This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. Simply Wall St has no position in the stocks mentioned.

We aim to bring you long-term focused research analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Thank you for reading.