Diamondback Energy Clips 5% Output View Amid Oil Price Plunge

The oil industry is in shambles, thanks to the coronavirus pandemic that shook most sectors until now. Global fuel demand is visibly dented in the aftermath of large-scale travel bans imposed globally. To worsen matters, oil prices plummeted as Saudi Arabia waged a price war and ramped up its oil production significantly in retaliation to Russia’s resistance to lower its crude production at the OPEC meeting.

Notably, West Texas Intermediate commenced the year with a little more than $60 per barrel of oil. However, this uptick was momentary with the WTI price drooping to $20.09 on Monday, hitting rock bottom since February 2002.

In response to this weak oil scenario, Diamondback Energy, Inc. FANG recently announced plans to lower its production guidance for 2020. It also intends to hedge majority of its output.

Management stated that 2020 production is now expected to average at 295,000-310,000 barrels of oil equivalent per day (Boe/d), marking a 5% decline at the midpoint from its previous guidance of 310,000-325,000 Boe/d. For the full year, it now anticipates oil production in the range of 183,000-193,000 barrels per day (BPD), lower than previous quarter’s 195,000 BPD.

A few days back, this Midland, TX-based exploration and production player announced a cutback in its completion activity, putting all completion crews functioning for the company on a one-three month long hiatus. Post the halting period, the company plans to resume its drilling activities, reactivate crews and operate three to five completion crews (indicating a reduction from 9 crews) along with the completion of 170-200 gross wells with roughly 10,000 feet average lateral length for the remainder of the year.

To check further deterioration in Diamondback Energy’s cash flows, the company has hedged a huge chunk of estimated oil production for 2020 and 2021 under the prevalent volatile oil price environment.

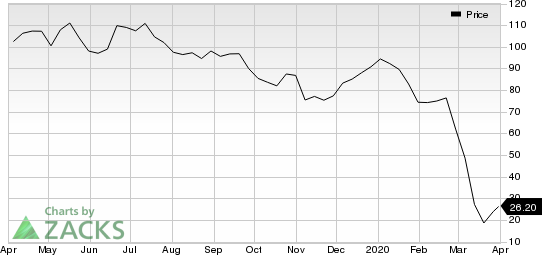

Diamondback Energy, Inc. Price

Diamondback Energy, Inc. price | Diamondback Energy, Inc. Quote

Notably, this Zacks Rank #5 (Strong Sell) Diamondback Energy’s affiliate organization, Viper Energy Partners VNOM is also planning to trim its 2020 production view to the tune of 22,500-27,000 boe/d from the prior expectation 27,000-30,000 Boe/d. It expects oil production in the range of 14,000-17,000 BPD, implying a decrease from the previous outlook of 17,000-19,000 BPD. You can see the complete list of today’s Zacks #1 Rank (Strong Buy) stocks here.

Earlier in March, Diamondback Energy announced its plan to slash its 2020 capex guidance by $1.2 billion (or in excess of 40%) to $1.5-$1.9 billion from its prior projection of $2.58-$3 billion. This strategic action comes at a time when the ongoing turmoil in the hydrocarbon market dwindled oil prices.

Several other companies with significant exploration and production activities are making similar moves to navigate through this tough phase while sustaining a solid financial footing and strong operational efficiency at the same time. Energy players like Pioneer Natural Resources Company PXD and Apache Corporation APA are curtailing expenditures for the current year and fortifying their capital positions when oil prices appear unprofitable for most producers.

Today's Best Stocks from Zacks

Would you like to see the updated picks from our best market-beating strategies? From 2017 through 2019, while the S&P 500 gained and impressive +53.6%, five of our strategies returned +65.8%, +97.1%, +118.0%, +175.7% and even +186.7%.

This outperformance has not just been a recent phenomenon. From 2000 – 2019, while the S&P averaged +6.0% per year, our top strategies averaged up to +54.7% per year.

See their latest picks free >>

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

Apache Corporation (APA) : Free Stock Analysis Report

Pioneer Natural Resources Company (PXD) : Free Stock Analysis Report

Diamondback Energy, Inc. (FANG) : Free Stock Analysis Report

Viper Energy Partners LP (VNOM) : Free Stock Analysis Report

To read this article on Zacks.com click here.

Zacks Investment Research