Declining Stock and Solid Fundamentals: Is The Market Wrong About Middlesex Water Company (NASDAQ:MSEX)?

Middlesex Water (NASDAQ:MSEX) has had a rough month with its share price down 5.0%. However, stock prices are usually driven by a company’s financial performance over the long term, which in this case looks quite promising. In this article, we decided to focus on Middlesex Water's ROE.

Return on Equity or ROE is a test of how effectively a company is growing its value and managing investors’ money. In simpler terms, it measures the profitability of a company in relation to shareholder's equity.

View our latest analysis for Middlesex Water

How To Calculate Return On Equity?

Return on equity can be calculated by using the formula:

Return on Equity = Net Profit (from continuing operations) ÷ Shareholders' Equity

So, based on the above formula, the ROE for Middlesex Water is:

11% = US$37m ÷ US$335m (Based on the trailing twelve months to June 2020).

The 'return' refers to a company's earnings over the last year. So, this means that for every $1 of its shareholder's investments, the company generates a profit of $0.11.

What Is The Relationship Between ROE And Earnings Growth?

Thus far, we have learned that ROE measures how efficiently a company is generating its profits. Depending on how much of these profits the company reinvests or "retains", and how effectively it does so, we are then able to assess a company’s earnings growth potential. Generally speaking, other things being equal, firms with a high return on equity and profit retention, have a higher growth rate than firms that don’t share these attributes.

A Side By Side comparison of Middlesex Water's Earnings Growth And 11% ROE

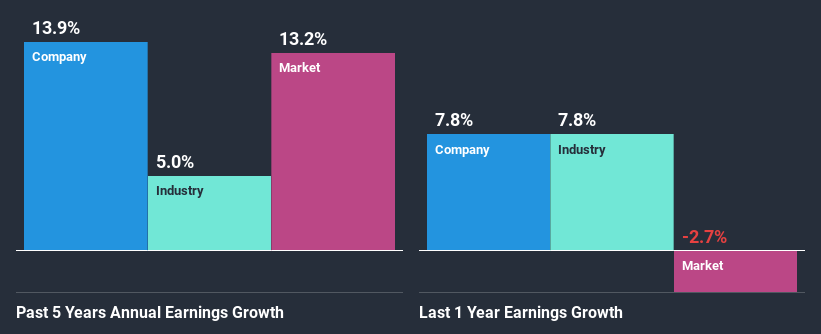

To start with, Middlesex Water's ROE looks acceptable. Further, the company's ROE compares quite favorably to the industry average of 7.7%. This probably laid the ground for Middlesex Water's moderate 14% net income growth seen over the past five years.

We then compared Middlesex Water's net income growth with the industry and we're pleased to see that the company's growth figure is higher when compared with the industry which has a growth rate of 5.0% in the same period.

Earnings growth is a huge factor in stock valuation. What investors need to determine next is if the expected earnings growth, or the lack of it, is already built into the share price. Doing so will help them establish if the stock's future looks promising or ominous. Is Middlesex Water fairly valued compared to other companies? These 3 valuation measures might help you decide.

Is Middlesex Water Using Its Retained Earnings Effectively?

Middlesex Water has a healthy combination of a moderate three-year median payout ratio of 48% (or a retention ratio of 52%) and a respectable amount of growth in earnings as we saw above, meaning that the company has been making efficient use of its profits.

Moreover, Middlesex Water is determined to keep sharing its profits with shareholders which we infer from its long history of paying a dividend for at least ten years.

Conclusion

On the whole, we feel that Middlesex Water's performance has been quite good. Particularly, we like that the company is reinvesting heavily into its business, and at a high rate of return. Unsurprisingly, this has led to an impressive earnings growth. If the company continues to grow its earnings the way it has, that could have a positive impact on its share price given how earnings per share influence long-term share prices. Not to forget, share price outcomes are also dependent on the potential risks a company may face. So it is important for investors to be aware of the risks involved in the business. You can see the 3 risks we have identified for Middlesex Water by visiting our risks dashboard for free on our platform here.

This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com.