Crude Oil Price Update – Room to the Upside Over $52.65

U.S. West Texas Intermediate crude oil futures rebounded from early session weakness on Tuesday to close marginally higher for the session. Shortly after the early session open, the market was pressured by concerns over the impact on crude demand from the coronavirus outbreak in China and a lack of further action by OPEC and its allies to support the market.

On Tuesday, April WTI crude oil settled at $52.36, up 0.04 or +0.08%.

Daily Technical Analysis

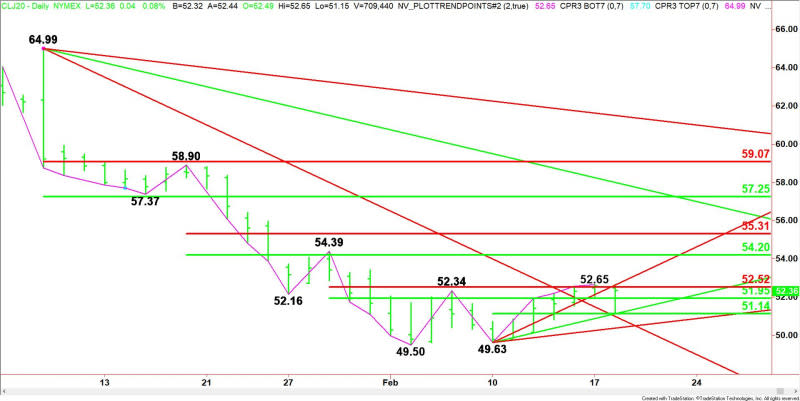

The main trend is up according to the daily swing chart. The trend turned up on February 13 when buyers took out the last main top at $52.34, however, the rally stalled at $52.65. Taking out this top will signal a resumption of the uptrend. The main trend will change to down on a move through the last swing bottom at $49.63.

The minor trend is also up. The new minor top is $52.65. A trade through this level will reestablish the upside momentum.

The minor range is $49.63 to $52.65. Its 50% level at $51.14 is support. Tuesday’s low came in at $51.15.

The short-term range is $54.39 to $49.50. Its retracement zone at $51.95 to $52.52 is resistance.

The intermediate range is $58.90 to $49.50. Its retracement zone at $54.20 to $55.31 is the next potential upside target range.

Tuesday’s Recap

On Tuesday, the market struggled early with a resistance cluster at $52.63 to $52.65. The key thing to remember about resistance clusters is that they also act as trigger points for accelerations to the upside. (Take a look at what gold did on Tuesday when it took out a price cluster consisting of three potential resistance points.)

Our work suggests that overcoming $52.65 could launch the market into the next potential resistance cluster at $54.20 to $54.39.

On the downside, support was clusters at $51.14 to $51.13. The market didn’t get there, however, stopping at $51.15 before turning higher.

Moving forward, support and resistance isn’t clustered, but rather layered.

This article was originally posted on FX Empire

More From FXEMPIRE:

EUR/USD Mid-Session Technical Analysis for February 18, 2020

Economic Data Puts the GBP, USD and Loonie in the Spotlight, with the FOMC Minutes also in Focus

European Equities: Risk Pendulum Swings in Favor of the Bulls Ahead of the Open

Natural Gas Price Prediction – Prices Break Above Trend Line Resistance on Cold Weather Forecast