Some Confidence Is Lacking In PC Connection, Inc.'s (NASDAQ:CNXN) P/E

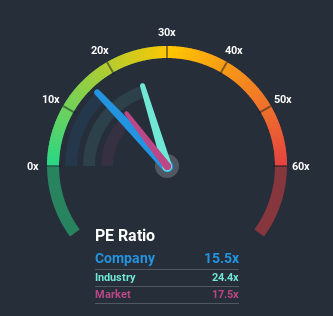

There wouldn't be many who think PC Connection, Inc.'s (NASDAQ:CNXN) price-to-earnings (or "P/E") ratio of 15.5x is worth a mention when the median P/E in the United States is similar at about 17x. However, investors might be overlooking a clear opportunity or potential setback if there is no rational basis for the P/E.

The recently shrinking earnings for PC Connection have been in line with the market. It seems that few are expecting the company's earnings performance to deviate much from most other companies, which has held the P/E back. You'd much rather the company wasn't bleeding earnings if you still believe in the business. At the very least, you'd be hoping that earnings don't accelerate downwards if your plan is to pick up some stock while it's not in favour.

View our latest analysis for PC Connection

If you'd like to see what analysts are forecasting going forward, you should check out our free report on PC Connection.

What Are Growth Metrics Telling Us About The P/E?

PC Connection's P/E ratio would be typical for a company that's only expected to deliver moderate growth, and importantly, perform in line with the market.

Retrospectively, the last year delivered a frustrating 3.7% decrease to the company's bottom line. Even so, admirably EPS has lifted 46% in aggregate from three years ago, notwithstanding the last 12 months. Although it's been a bumpy ride, it's still fair to say the earnings growth recently has been more than adequate for the company.

Shifting to the future, estimates from the two analysts covering the company suggest earnings growth is heading into negative territory, declining 4.8% over the next year. Meanwhile, the broader market is forecast to expand by 5.5%, which paints a poor picture.

In light of this, it's somewhat alarming that PC Connection's P/E sits in line with the majority of other companies. It seems most investors are hoping for a turnaround in the company's business prospects, but the analyst cohort is not so confident this will happen. There's a good chance these shareholders are setting themselves up for future disappointment if the P/E falls to levels more in line with the negative growth outlook.

The Key Takeaway

Using the price-to-earnings ratio alone to determine if you should sell your stock isn't sensible, however it can be a practical guide to the company's future prospects.

We've established that PC Connection currently trades on a higher than expected P/E for a company whose earnings are forecast to decline. Right now we are uncomfortable with the P/E as the predicted future earnings are unlikely to support a more positive sentiment for long. Unless these conditions improve, it's challenging to accept these prices as being reasonable.

And what about other risks? Every company has them, and we've spotted 1 warning sign for PC Connection you should know about.

Of course, you might find a fantastic investment by looking at a few good candidates. So take a peek at this free list of companies with a strong growth track record, trading on a P/E below 20x.

This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com.