Should China 21st Century Education Group Limited (HKG:1598) Be Part Of Your Dividend Portfolio?

Dividend paying stocks like China 21st Century Education Group Limited (HKG:1598) tend to be popular with investors, and for good reason - some research suggests a significant amount of all stock market returns come from reinvested dividends. On the other hand, investors have been known to buy a stock because of its yield, and then lose money if the company's dividend doesn't live up to expectations.

The company also bought back stock during the year, equivalent to approximately 1.2% of the company's market capitalisation at the time. Some simple analysis can offer a lot of insights when buying a company for its dividend, and we'll go through this below.

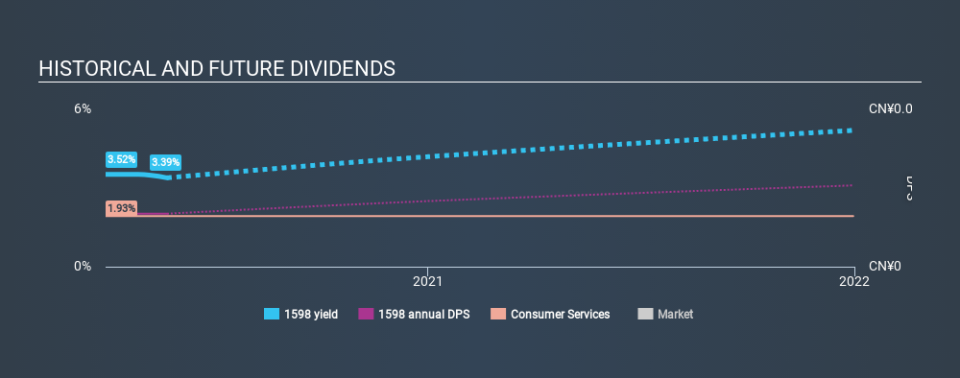

Click the interactive chart for our full dividend analysis

Payout ratios

Dividends are typically paid from company earnings. If a company pays more in dividends than it earned, then the dividend might become unsustainable - hardly an ideal situation. So we need to form a view on if a company's dividend is sustainable, relative to its net profit after tax. Looking at the data, we can see that 29% of China 21st Century Education Group's profits were paid out as dividends in the last 12 months. A medium payout ratio strikes a good balance between paying dividends, and keeping enough back to invest in the business. One of the risks is that management reinvests the retained capital poorly instead of paying a higher dividend.

While the above analysis focuses on dividends relative to a company's earnings, we do note China 21st Century Education Group's strong net cash position, which will let it pay larger dividends for a time, should it choose.

We update our data on China 21st Century Education Group every 24 hours, so you can always get our latest analysis of its financial health, here.

Dividend Volatility

One of the major risks of relying on dividend income, is the potential for a company to struggle financially and cut its dividend. Not only is your income cut, but the value of your investment declines as well - nasty. This company has been paying a dividend for less than 2 years, which we think is too soon to consider it a reliable dividend stock.

We like that the dividend hasn't been shrinking. However we're conscious that the company hasn't got an overly long track record of dividend payments yet, which makes us wary of relying on its dividend income.

Dividend Growth Potential

The other half of the dividend investing equation is evaluating whether earnings per share (EPS) are growing. Growing EPS can help maintain or increase the purchasing power of the dividend over the long run. China 21st Century Education Group's earnings per share are up 4.5% on last year. We're glad to see EPS up on last year, but we're conscious that growth rates typically slow as companies increase in size. A payout ratio below 50% leaves ample room to reinvest in the business, and provides finanical flexibility. However, earnings per share are unfortunately not growing much. Might this suggest that the company should pay a higher dividend instead? We do note though, one year is too short a time to be drawing strong conclusions about a company's future prospects.

Conclusion

To summarise, shareholders should always check that China 21st Century Education Group's dividends are affordable, that its dividend payments are relatively stable, and that it has decent prospects for growing its earnings and dividend. We're glad to see China 21st Century Education Group has a low payout ratio, as this suggests earnings are being reinvested in the business. Unfortunately, earnings growth has also been mediocre, and we think it has not been paying dividends long enough to demonstrate resilience across economic cycles. Overall we think China 21st Century Education Group is an interesting dividend stock, although it could be better.

Companies possessing a stable dividend policy will likely enjoy greater investor interest than those suffering from a more inconsistent approach. However, there are other things to consider for investors when analysing stock performance. As an example, we've identified 1 warning sign for China 21st Century Education Group that you should be aware of before investing.

If you are a dividend investor, you might also want to look at our curated list of dividend stocks yielding above 3%.

Love or hate this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com.

This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned. Thank you for reading.