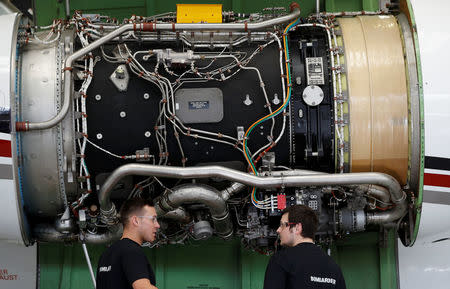

Bombardier revs up aftermarket business to hit revenue growth target

By Allison Lampert

Montreal (Reuters) - With its new long-range business jet just preparing to take flight, Bombardier is banking on sales of new products and maintenance packages to help it drive promised double-digit revenue growth for its aftermarket service business this year.

Bombardier, which considered bankruptcy in 2015 after facing a cash-crunch, is in the middle of an aggressive turnaround plan that leans on the delivery of its new long-range, Global 7000 business jet to achieve a 25 percent jump in total company revenues to $20 billion by 2020, compared with 2017.

But with demand now flat for other jets and the new Global 7000 just starting to come off the line this year before picking up the pace in 2019 and 2020, Bombardier is counting on upside from the so-called aftermarket business of servicing existing jets.

The Canadian company expects its business jet division will, by year's end, maintain 35 percent of the 4,700 in-service jets it has sold over the years, up from 25 percent in 2017, according to Bill Molloy, vice president, aftermarket sales and commercial strategy of Bombardier's business jet division.

That will help generate double-digit revenue growth this year from such aftermarket services, which it expects will rise by $500 million in total through 2020, he told Reuters.

Bombardier does not disclose revenue figures for its aftermarket services business, but total revenues from Bombardier’s business aircraft are expected to grow to $8.5 billion in 2020, up from $5 billion in 2017.

New requirements for global positioning systems in planes, along with demand for improved avionics, faster internet service and other offerings, are expected to draw in more customers for its jet maintenance.

"You bring the aircraft into your facility and then you've got the opportunity to apply your modifications and upgrades," Molloy said.

Meeting those new aftermarket targets is possible given Bombardier’s recent investment in that side of the business – which is already a mainstay for the likes of Boeing Co and other plane makers.

Bombardier expanded its facility network by a third to 1.5 million square feet, introduced about 30 new product upgrades in its maintenance centers this year and is set to unveil about a dozen more services - including new cockpit displays and global positioning system installations required by U.S. and European regulators.

It also plans to double capacity within the next 18 to 24 months in Florida, a geographically strategic location which serves customers from both the United States and Latin America, while also eying future growth in Asia, Molloy said.

"Maintenance is a very important driver” of revenues, said Molloy.

Bombardier is expecting greater demand from customers for ADS-B out, which broadcasts the plane's position and will be required by U.S. and European regulators in 2020.

The demand potential is significant for Bombardier and other jet service providers because according to January 2018 data from the Federal Aviation Administration, only about a third of U.S.-registered business jets and general aviation turboprops currently meet the new regulations.

While the ADS-B is one of many new service offerings, the expectation is that it will spur more customers to bring their planes back, and then combine the visit to Bombardier's centers with more lucrative scheduled maintenance and upgrades.

"You bring the aircraft into your facility and then you've got the opportunity to apply your modifications and upgrades," said Molloy.

The company will further expand its global network of nine service centers by 2020 and expects higher demand for installations next year as owners rush to meet the 2020 aircraft ADS-B installation deadline in the United States and Europe.

"I can see the mad scramble in 2019," Molloy said in an interview.

A 2019 bottleneck could result because some plane owners are delaying their installations with the hope that "lower cost options will be available in the next 6-9 months," said Warren Peck, president of Phoenix Rising Aviation, an Oklahoma-based maintenance and repair operation specializing in Dassault Aviation SA Falcon jets.

Ron Smith, a sales manager for business and general aviation at supplier Honeywell Aerospace, said by phone that some installers are already having "bandwidth limitations to accommodate all the people who are trying to update."

Honeywell, which makes some of the equipment used to install ADS-B, has seen about a 20 percent increase in those orders during the first two months of 2018, compared with the same period a year earlier.

The U.S. and European directives follow similar regulations in Australia. And now Canada is weighing whether to add an ADS-B requirement, which could start as early as 2021, said a spokesman for NavCan, the operator of the country's air traffic control services.

Molloy said Bombardier is taking steps to prepare, including keeping enough parts and staff, in anticipation of an influx demand fueled by ADS-B requirements next year.

(Reporting By Allison Lampert; Editing by Denny Thomas and Edward Tobin)