BOE Reserves Enter UK Election Debate as Politicians Chase Cash

(Bloomberg) -- UK politicians are mulling changes to the way the Bank of England pays out interest to commercial banks as they look for ways to generate more fiscal headroom ahead of elections next month.

Most Read from Bloomberg

Wells Fargo Fires Over a Dozen for ‘Simulation of Keyboard Activity’

Apple to ‘Pay’ OpenAI for ChatGPT Through Distribution, Not Cash

Hunter Biden Was Convicted. His Dad’s Reaction Was Remarkable.

US Producer Prices Surprise With Biggest Decline Since October

Tech-Led Rally Props Up Stocks as US Yields Slide: Markets Wrap

The most radical proposal came from Nigel Farage’s right-wing populist party Reform UK, which over the weekend advocated scrapping payments entirely, a move he claims could save the government £35 billion ($45 billion) a year.

Labour’s shadow chancellor Rachel Reeves on Tuesday joined the debate by warning of the dangers that even a moderate change to way the BOE compensates banks — under a so-called tiering system — would have on monetary policy transmission.

That an obscure topic is being politicized in the election campaign shows how far politicians are going to find room for public spending. Both main parties are effectively signed up to the same fiscal rules, which leave them no room to maneuver unless they raise taxes or find other savings. But public debt as a percentage of gross domestic product is at the highest levels since the 1960s, and the nation has already committed to one of its biggest annual borrowing sprees on record.

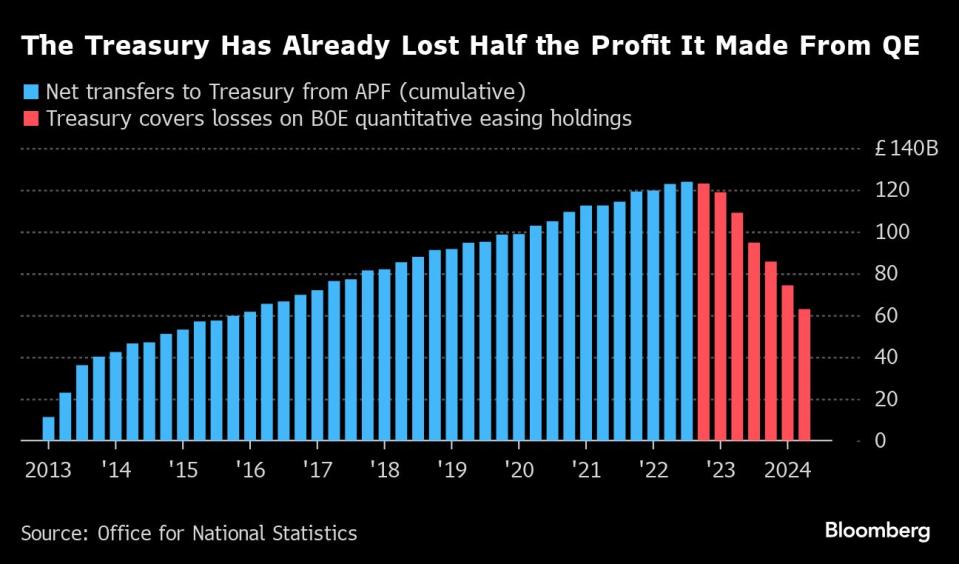

As the BOE’s only shareholder, the Treasury is accountable for its balance sheet. For years that wasn’t a problem as the central bank was profitable, but things changed as interest rates shot up. Now it is generating losses to the government, mainly because the interest rate it pays out on reserves — the Bank Rate — is higher than the coupon income it earns on the bonds it holds.

That mismatch has been a topic of discussion before. Back in March, former UK prime minister and Labour leader Gordon Brown proposed changing the rules around the BOE’s quantitative-easing program, a sign the party could copy the European Central Bank’s tiering reserves remuneration. In that system, a portion is paid either zero interest or a discounted rate. Former prime minister Liz Truss also considered a change in 2022.

The main issue with that overhaul is it may impact the transmission of monetary policy. Reeves argued that remunerating reserves is one of the ways that higher rates filter through to the real economy and said her party had “no plans” to change it.

It also has an impact on UK lenders. NatWest Group Plc, Lloyds Banking Group Plc, Barclays Plc and Santander UK together made £9.23 billion last year from interest on BOE reserves, which soared between 2009 and 2021 due to the central bank’s quantitative easing program to boost the economy. Bloomberg Intelligence estimates such a change could cost about £1.5 billion to the country’s lenders.

“Take the policy too far and the BOE will lose control of interest rates in money markets,” BI analysts including Tomasz Noetzel wrote in a report. “It could also disturb the way monetary policy is transmitted just as the BOE is considering when to cut interest rates.”

Most Read from Bloomberg Businessweek

Israeli Scientists Are Shunned by Universities Over the Gaza War

Grieving Families Blame Panera’s Charged Lemonade for Leaving a Deadly Legacy

The World’s Most Online Male Gymnast Prepares for the Paris Olympics

China’s Economic Powerhouse Is Feeling the Brunt of Its Slowdown

©2024 Bloomberg L.P.