Our Take On Beyond International's (ASX:BYI) CEO Salary

Mikael Borglund is the CEO of Beyond International Limited (ASX:BYI), and in this article, we analyze the executive's compensation package with respect to the overall performance of the company. This analysis will also look to assess whether the CEO is appropriately paid, considering recent earnings growth and investor returns for Beyond International.

See our latest analysis for Beyond International

How Does Total Compensation For Mikael Borglund Compare With Other Companies In The Industry?

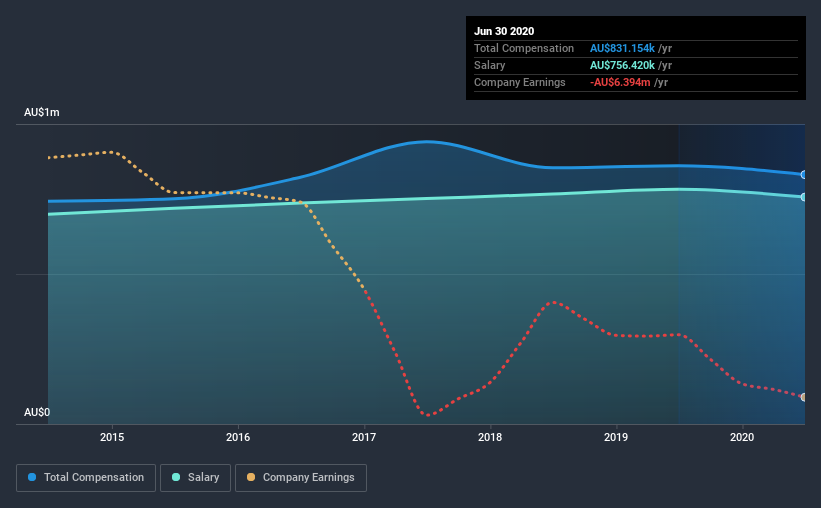

According to our data, Beyond International Limited has a market capitalization of AU$31m, and paid its CEO total annual compensation worth AU$831k over the year to June 2020. That's a slightly lower by 3.5% over the previous year. We note that the salary portion, which stands at AU$756.4k constitutes the majority of total compensation received by the CEO.

For comparison, other companies in the industry with market capitalizations below AU$275m, reported a median total CEO compensation of AU$206k. Hence, we can conclude that Mikael Borglund is remunerated higher than the industry median. Furthermore, Mikael Borglund directly owns AU$1.6m worth of shares in the company.

Component | 2020 | 2019 | Proportion (2020) |

Salary | AU$756k | AU$782k | 91% |

Other | AU$75k | AU$79k | 9% |

Total Compensation | AU$831k | AU$861k | 100% |

On an industry level, roughly 92% of total compensation represents salary and 8.1% is other remuneration. Beyond International is largely mirroring the industry average when it comes to the share a salary enjoys in overall compensation. If salary is the major component in total compensation, it suggests that the CEO receives a higher fixed proportion of the total compensation, regardless of performance.

Beyond International Limited's Growth

Beyond International Limited saw earnings per share stay pretty flat over the last three years. In the last year, its revenue is up 3.8%.

We would argue that the improvement in revenue is good, but isn't particularly impressive, but the modest improvement in EPS is good. It's clear the performance has been quite decent, but it it falls short of outstanding,based on this information. We don't have analyst forecasts, but you could get a better understanding of its growth by checking out this more detailed historical graph of earnings, revenue and cash flow.

Has Beyond International Limited Been A Good Investment?

With a three year total loss of 28% for the shareholders, Beyond International Limited would certainly have some dissatisfied shareholders. Therefore, it might be upsetting for shareholders if the CEO were paid generously.

To Conclude...

As we touched on above, Beyond International Limited is currently paying its CEO higher than the median pay for CEOs of companies belonging to the same industry and with similar market capitalizations. Over the last three years, shareholder returns have been downright disappointing for Beyond International, and although EPS growth is steady, it hasn't set the world on fire. This doesn't look great when you consider Mikael is taking home compensation north of the industry average. With such poor returns, we would understand if shareholders had concerns related to the CEO's pay.

It is always advisable to analyse CEO pay, along with performing a thorough analysis of the company's key performance areas. We identified 3 warning signs for Beyond International (2 are significant!) that you should be aware of before investing here.

Arguably, business quality is much more important than CEO compensation levels. So check out this free list of interesting companies that have HIGH return on equity and low debt.

This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com.