Baxter (BAX) Q3 Earnings and Revenues Surpass Estimates

Baxter International Inc. BAX reported third-quarter 2020 adjusted earnings of 83 cents per share, which outpaced the Zacks Consensus Estimate of 71 cents by 13.7%. Moreover, the bottom line improved 12.2% from the year-ago quarter.

Revenues of $2.97 billion beat the Zacks Consensus Estimate of $2.83 billion by 5.2%. The top line increased 4.2% year over year on a reported basis, while 4% and 3% on a constant currency (cc) and operational basis, respectively.

Geographical Details

Baxter reports operating results through three geographic segments — Americas (North and South America), EMEA (Europe, Middle East and Africa) and APAC (Asia Pacific).

In Americas, Baxter reported revenues of $1.55 billion, up 0.9% on a year-over-year basis and 2% at cc.

In EMEA, revenues totaled $777 million, up 6.4% from the year-ago quarter and 3% at cc.

In APAC, revenues of $646 million improved 10.1% from the prior-year quarter and 7% at cc.

Segmental Details

Renal Care

This segment reported revenues of $955 million in the quarter under review, up 4% year over year. Revenues at the segment increased 4% at cc.

Medication Delivery

Revenues at the segment amounted to $680 million, down 3% from the year-ago quarter and 3% at cc.

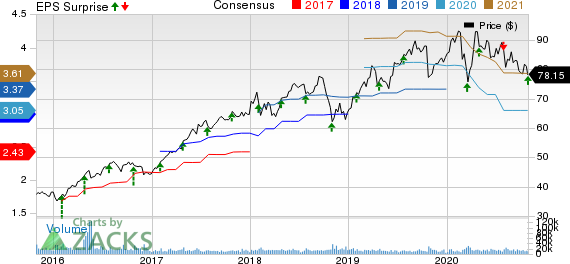

Baxter International Inc. Price, Consensus and EPS Surprise

Baxter International Inc. price-consensus-eps-surprise-chart | Baxter International Inc. Quote

Pharmaceuticals

Revenues at the segment totaled $540 million, up 2.5% from the year-ago quarter and 1% at cc.

Clinical Nutrition

Revenues at the segment were $237 million, up 8.2% from the year-ago quarter and 5% at cc.

Advanced Surgery

Revenues at the segment amounted to $236 million, up 9.3% from the year-ago quarter and 9% at cc.

Acute Therapies

This segment reported revenues of $177 million, up 36.2% from the prior-year quarter and 35% at cc.

Other

Revenues in the segment were $147 million, up 5% on a year-over-year basis and 4% at cc.

Margin Analysis

Baxter reported gross profit of $1.19 billion in the third quarter, down 2.8% year over year. As a percentage of revenues, gross margin contracted 290 basis points (bps) on a year-over-year basis at 40.2% in the second quarter.

Operating income fell 6.6% year over year to $470 million in the quarter under review. As a percentage of revenues, operating margin contracted 180 bps to 15.8% in the quarter under review.

Guidance

For full-year 2020, Baxter anticipates low-single digit sales growth on a reported, constant currency and operational basis.

Adjusted earnings per share is estimated in the range of $3.02 to $3.05. The Zacks Consensus Estimate for the same is pegged at $3.05.

It is worth mentioning that the aforementioned outlook takes into account, among other factors, low double-digit declines in hospital admissions and mid-single digit declines in surgical volumes in fourth-quarter 2020 in comparison to pre-COVID-19 levels.

Summing Up

Baxter ended third-quarter 2020 on a strong note, with both earnings and revenues beating the Zacks Consensus Estimate. The company saw strong performance across six of its business units. Growth in EMEA and APAC instills optimism.

The company received FDA De Novo authorization for Theranova, which is a novel dialysis membrane developed to provide expanded hemodialysis (HDx) therapy that filters a wider range of molecules from blood than traditional hemodialysis (HD) filters.

Moreover, Baxter got the FDA Emergency Use Authorizations (EUAs) for its Regiocit replacement solution, HF20 Set and ST Set — products utilized in continuous renal replacement therapy (CRRT). The EUAs will provide clinicians with new options to offer care for critically ill patients amid rising demand for CRRT as a result of the COVID-19 pandemic.

Also, the company entered into a distribution agreement with bioMérieux — a global leader in in vitro diagnostics — for the NEPHROCLEAR CCL14 diagnostic test. Additionally, Baxter was granted FDA approval of new formulations of Clinimix (amino acids in dextrose) Injections and Clinimix E (amino acids with electrolytes in dextrose and calcium) Injections.

Baxter is also supporting a new investigator-initiated study that exhibits the role of indirect calorimetry (IC) in boosting the accuracy of measuring COVID-19 patients’ nutritional needs during their intensive care unit stay.

Meanwhile, weak performance across Medication Delivery segment is a dampener. Also, contraction in both gross and operating margins raises concern. Further, cut-throat competition in the MedTech markets remains a woe.

Zacks Rank

Baxter currently carries a Zacks Rank #4 (Sell).

Earnings of Other MedTech Majors at a Glance

Some better-ranked stocks in the broader medical space that have already announced their quarterly results are Thermo Fisher Scientific Inc. TMO, Align Technology, Inc. ALGN and AngioDynamics, Inc. ANGO, each carrying a Zacks Rank of 2 (Buy). You can see the complete list of today’s Zacks #1 Rank (Strong Buy) stocks here.

Thermo Fisher reported third-quarter 2020 adjusted EPS of $5.63, beating the Zacks Consensus Estimate by 28.8%. Revenues of $8.52 billion surpassed the consensus mark by 10%.

Align Technology reported third-quarter 2020 adjusted EPS of $2.25, which surpassed the Zacks Consensus Estimate by 281.4%. Revenues of $734.1 million outpaced the consensus mark by 38%.

AngioDynamics reported first-quarter fiscal 2021 adjusted earnings per share (EPS) of 2 cents against the Zacks Consensus Estimate of a loss per share of 6 cents. Revenues of $70.2 million beat the consensus mark by 6.9%.

Looking for Stocks with Skyrocketing Upside?

Zacks has just released a Special Report on the booming investment opportunities of legal marijuana.

Ignited by referendums and legislation, this industry is expected to blast from an already robust $17.7 billion in 2019 to a staggering $73.6 billion by 2027. Early investors stand to make a killing, but you have to be ready to act and know just where to look.

See the pot stocks we're targeting >>

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

AngioDynamics, Inc. (ANGO) : Free Stock Analysis Report

Baxter International Inc. (BAX) : Free Stock Analysis Report

Align Technology, Inc. (ALGN) : Free Stock Analysis Report

Thermo Fisher Scientific Inc. (TMO) : Free Stock Analysis Report

To read this article on Zacks.com click here.

Zacks Investment Research