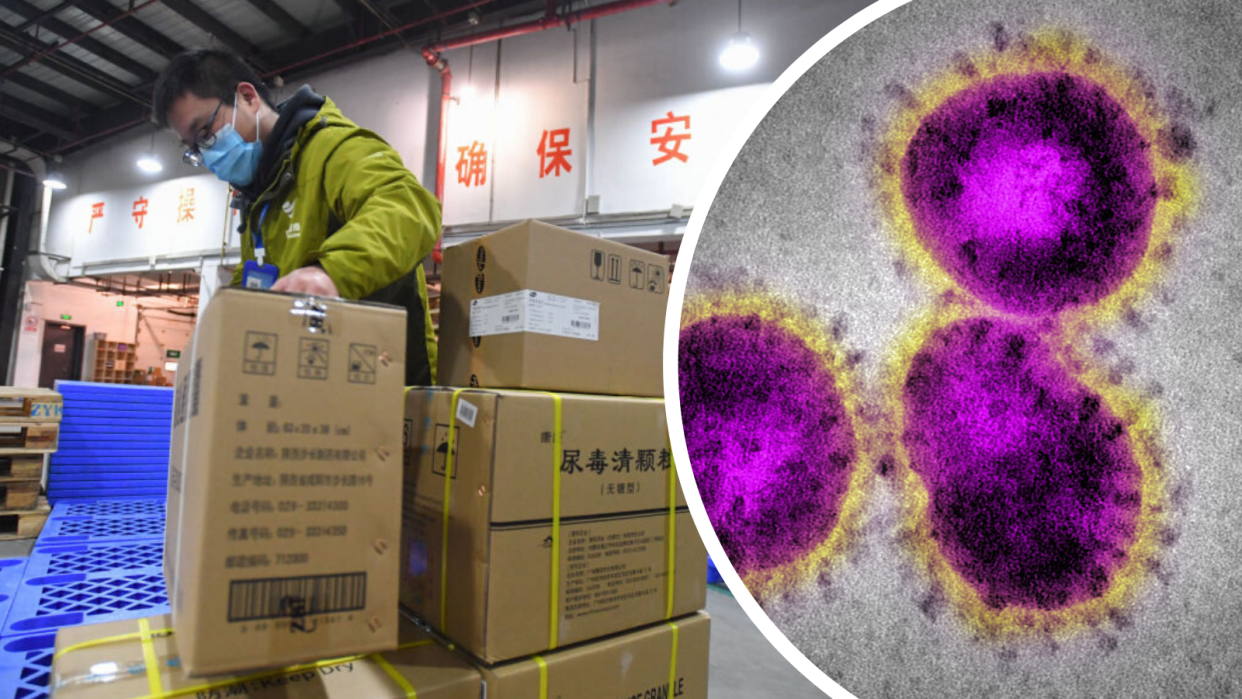

'Major issue': Aussie businesses stuck in coronavirus gridlock

Across the globe, coronavirus has claimed over 2,000 lives.

While no Australians have died as a result of the disease, businesses are being killed left, right and centre.

Jack Bloomfield, a 17-year-old Australian entrepreneur, told Yahoo Finance while the impact wasn’t huge during the initial outbreak of the virus, the effect is being felt now.

“Suppliers had stock on back order so were able to fulfill orders, but the effect [of the virus] is starting to be felt now as the months roll on,” Bloomfield said.

According to recent Roy Morgan research, one-in-six Australian businesses have already been affected by the coronavirus – just a month after bushfires impacted more than a quarter of businesses.

Also read: ‘A dead town’: Restaurants take whopping 80% hit from coronavirus

Also read: Domino effect: How coronavirus will hit Australia

Also read: Apple, other businesses feel virus' chill: 'I think we're starting to worry'

And the virus is not discriminating. According to the survey of 1,170 Australian businesses, the accommodation, food, travel, tourism, admin, support, property and business sectors are all feeling the pinch.

Businesses named quarantine as the biggest business blocker.

“We have workers that are in isolation to recover from potential exposure to the virus,” one business stated.

“We have enforced staff absence from office due to recent travel to the areas in question,” another reported.

This quarantine issue is exacerbated by the fact that Lunar New Year fell during the outbreak, leaving Chinese workers returning home for celebrations stuck, and unable to return to work.

“It could not have come at a worse time,” Bloomfield said.

“With many Chinese workers travelling to Wuhan and not being allowed to leave… products simply aren’t being produced in the quantity they usually were.”

And the issue is trickling down to consumers.

“Customers don’t realise that the majority of their products are purchased from China, which means not only does this virus affect retailers and dropshippers like myself, but ultimately it affects the average customer.”

Crown posts profit downturn

Crown Resorts posted a 11 per cent dive in its net profit this year, with chief executive Ken Barton flagging coronavirus as a reason for soft trade.

The casino operator stated its main floor gaming and non-gaming revenues were higher in Perth before the coronavirus outbreak.

"Crown has recently experienced softer trading conditions as a result of travel restrictions and general community uncertainty in response to Covid-19 [coronavirus], particularly over the Lunar New Year period," Barton said of the results.

Australian tourism businesses falter

Inbound tourism businesses have been hit by the virus outbreak, with visitors unable to travel to the country due to flight bans.

Kee Guan-Saw, partner at Melbourne accounting firm, KST Partners, told Yahoo Finance one of his client’s tourism businesses has been hit dramatically.

“The business is trying to get back deposits worth hundreds of thousands of dollars from hotels and various attractions. If they’re successful they will be okay, but if not then the business will suffer,” Guan-Saw said.

“And looking forward, if the coronavirus endures and the federal government issues a full travel ban, many businesses like this will be devastated.”

Sydney’s Big Bus Tours also flagged virus concerns with Yahoo Finance.

“Big Bus is committed to supporting domestic and global travel. Although we are experiencing some short-term softness in international demand as a result of the Australian bush fires and Coronavirus, Big Bus is still seeing good growth globally across its diverse portfolio of 23 world cities,” a spokesperson said.

Restaurants have also been feeling the pinch of the virus, prompting the launch of a social media campaign called #IWillEatWithYou to boost tourism to Chinese eateries across the nation.

Make your money work with Yahoo Finance’s daily newsletter. Sign up here and stay on top of the latest money, news and tech news.

Follow Yahoo Finance Australia on Facebook, Twitter, Instagram and LinkedIn.