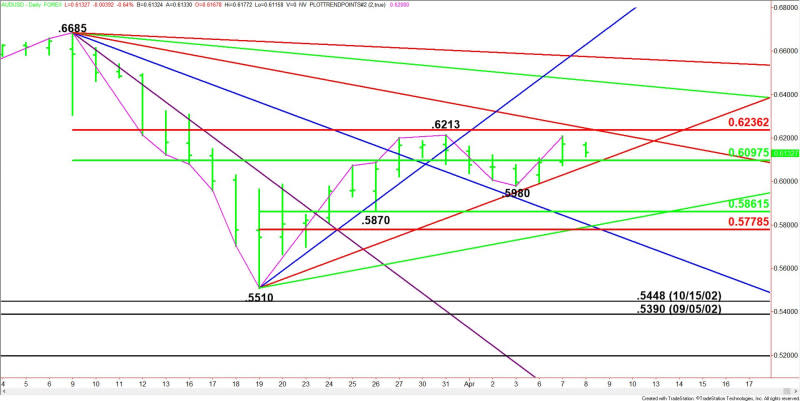

AUD/USD Forex Technical Analysis – Rangebound; Upside Bias Over .6245, Downside Bias Under .6070

The Australian Dollar is under pressure on Wednesday after global ratings agency S&P lowered its outlook on Australia’s coveted ‘AAA’ rating to “negative” from “stable” in anticipation of a “material” weakening in the government’s debt position as it splashes out a large fiscal stimulus package.

According to Reuters, S&P affirmed Australia’s prized rating but said a downgrade was possible within the next two years if the economic damage from the COVID-19 outbreak is more severe or prolonged than it currently expects.

At 09:05 GMT, the AUD/USD is trading .6146, down 0.0026 or -0.42%.

This would cause a “substantial deterioration of the government’s fiscal headroom at the ‘AAA’ rating level,” S&P said in a statement.

Daily Technical Analysis

The main trend is down according to the daily swing chart. A trade through .6213 will change the main trend to up. A move through .5980 will signal a resumption of the downtrend.

The main range is .6685 to .5510. The AUD/USD is currently trading inside its retracement zone at .6097 to .6236. Trader reaction to this zone should determine the near-term direction of the Forex pair.

The short-term range is .5510 to .6213. Its retracement zone at .5861 to .5778 is the primary downside target.

Daily Technical Forecast

The AUD/USD is currently sitting inside a triangle formed by a pair of Gann angles and a retracement zone. This indicates investor indecision and impending volatility. This is a breakout formation so start preparing for an acceleration.

Bullish Scenario

If risk-takers return then look for a rally into a resistance cluster at .6236 to .6245.

Taking out .6245 could trigger an acceleration to the upside with the next major target angle coming in at .6465.

Bearish Scenario

If sellers regain control then look for a break into .6097 to .6070.

Taking out .6070 could trigger an acceleration to the downside with the next targets a main bottom at .5980 and a short-term 50% level at .5861.

Side Notes

Basically, we’re looking for an upside bias to develop on a move over .6245, and for the downside bias to resume under .6070. If playing the breakout then make sure you have strong volume on your side because you could get whip-sawed.

This article was originally posted on FX Empire