Will App Store & Music Push Aid Apple's (AAPL) Q3 Earnings?

Apple’s AAPL non-iPhone segments including Services, Mac and iPad are expected to have benefited third-quarter fiscal 2020 results, scheduled to be released on Jul 30.

The Services business, which includes revenues from the App Store, Apple Music, iCloud, Apple Arcade, Apple TV+, Apple News+ and Apple Card, became the new cash cow for the company. Services revenues accounted for 22.9% of sales in second-quarter fiscal 2020.

During the quarter, Apple announced the addition of new markets for its major services including the App Store, iCloud, Apple Podcasts and its subscription-based gaming service, Arcade. These are now available in 20 new countries, with Apple Music now being available in 52 new territories.

Notably, the newest expansion brought the total count for App Store availability to 175 and Music to 167 out of the 193 United Nations-recognized countries in the world.

The expansion is expected to have accelerated adoption of these services in the to-be-reported quarter.

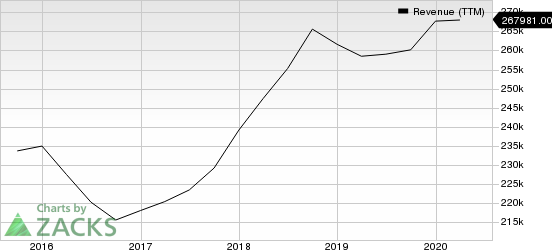

Apple Inc. Revenue (TTM)

Apple Inc. revenue-ttm | Apple Inc. Quote

The Zacks Consensus Estimate for Services revenues is pegged at $13.13 billion, indicating 14.6% growth from the year-ago quarter’s reported figure.

Markedly, Apple’s flagship iPhone unit sales are expected to have been muted due to the coronavirus outbreak in China that significantly disrupted the supply chain. Hence, the performance of these non-iPhone segments will be eagerly watched by investors to measure the success of Apple’s revenue-diversification strategy.

The consensus mark for iPhone sales currently stands at $20.29 billion, indicating a 22% decline from the year-ago quarter’s reported figure.

Click here to know how Apple’s overall third-quarter results are likely to be.

Apple’s iPad & Mac Portfolio to Aid Growth

Apple expects Mac and iPad revenues to improve in the to-be-reported quarter.

During the quarter, Apple updated the 13-inch MacBook Pro with the new Magic Keyboard and doubled the storage across all standard configurations. The new line-up also offers 10th-generation processors for up to 80% faster graphics performance and makes 16GB of speedy 3733MHz memory standard on select configurations.

Apple’s Mac sales are also expected to have been positively impacted by the remote working and learning wave. Per Gartner data, Apple saw its Mac shipment volumes expand 5.1% year over year in the second quarter.

Markedly, HP HPQ gained 17.1%, while Dell Technologies DELL shipment declined 0.3% in second-quarter 2020.

The Zacks Consensus Estimate for Mac revenues stands at $5.86 billion, implying 0.6% growth from the figure reported in the year-ago quarter.

Moreover, the consensus mark for iPad revenues is pegged at $4.10 billion, suggesting 15.8% drop from the figure reported in the year-ago quarter.

Notably, Apple previewed iOS 14, iPadOS 14, macOS Big Sur and WatchOS 7 at its first-ever virtual Worldwide Developers Conference in June. As anticipated, this Zacks Rank #3 (Hold) company announced that it will launch Macs that use Apple’s custom silicon late this year. The complete transition from Intel INTC-based Macs is expected to take a couple of years. You can see the complete list of today’s Zacks #1 Rank (Strong Buy) stocks here.

Soft Wearables Sales in Q3

Apple dominates the wearables and hearables market despite increasing competition from the likes of Fitbit, Garmin, Samsung and China's Huawei Technologies and Xiaomi Corp.

However, on a year-over-year basis, Apple expects third-quarter Wearables business revenues to be worse than the second quarter, primarily due to supply chain constraints.

Markedly, the consensus mark for wearables is currently pegged at $5.92 billion, indicating growth of 7.1% from the figure reported in the year-ago quarter but down 5.8% from the figure reported in the previous quarter.

These Stocks Are Poised to Soar Past the Pandemic

The COVID-19 outbreak has shifted consumer behavior dramatically, and a handful of high-tech companies have stepped up to keep America running. Right now, investors in these companies have a shot at serious profits. For example, Zoom jumped 108.5% in less than 4 months while most other stocks were sinking.

Our research shows that 5 cutting-edge stocks could skyrocket from the exponential increase in demand for “stay at home” technologies. This could be one of the biggest buying opportunities of this decade, especially for those who get in early.

See the 5 high-tech stocks now>>

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

HP Inc. (HPQ) : Free Stock Analysis Report

Dell Technologies Inc. (DELL) : Free Stock Analysis Report

Intel Corporation (INTC) : Free Stock Analysis Report

Apple Inc. (AAPL) : Free Stock Analysis Report

To read this article on Zacks.com click here.

Zacks Investment Research