Amazon to Create 1 Million Jobs in India, Expand Footprint

Amazon AMZN is leaving no stone unturned to bolster its presence in India. This is evident from its latest announcement of creating 1 million jobs in that country.

Reportedly, the company strives to create these jobs in both direct and indirect form. The e-commerce giant aims to reach the target of 1 million jobs by 2025.

These jobs will require Amazon’s investment in logistics, technology, skill development and infrastructure. Moreover, the company is also likely to involve jobs in content creation, retail and manufacturing.

We believe the latest move will be socially beneficial as job creation is always favorable for growing population of any country.

Notably, the new jobs will be in addition to the 700,000 jobs that the company has created in India till date over the past six years.

The jobs will bolster the talent pool of the company, which in turn, is expected to scale up its productivity level. Consequently, this will aid performance of Amazon’s Indian business unit.

Growing India-Based Initiatives

Amazon’s CEO Jeff Bezos recently made an announcement of $1 billion investment in India at the Smbhav summit in New Delhi.

With $1 billion investment, the e-commerce giant aims at building digital centers in 100 Indian cities and villages. We believe the proposed digital centers are likely to help over 10 million small and medium businesses (SMBs) to come online, which in turn, will expand their customer exposure.

Moreover, it will help Amazon in strengthening its e-commerce business in India by expanding its seller base and product offerings. The latest investment will be an addition to $5.5 billion investments in India, pledged by the company since 2014.

Amazon recently entered into a long-term agreement with Future Retail that will authorize it as the official online sales channel for Future’s retail stores.

Furthermore, Amazon has reportedly given its consent to acquire 49% stake comprising both voting and non-voting shares in Future Coupons, a Future Group entity.

Additionally, the company’s acquired 49% in More, a food and grocery supermarket chain, is a major positive. Amazon also owns 5% in Shoppers Stop.

All the above-mentioned endeavors have expanded Amazon’s footprint in India.

Amazon’s Global Footprint

We believe Amazon’s initiatives to strengthen its foothold in India are in sync with its growing efforts toward expanding its global footprint.

Apart from India, the company is reportedly planning to set up offline retail stores in Germany, which is considered to be its second-largest market after the United States. It also announced its intention to open a new fulfillment center in the country last year, in a bid to meet the growing demand in the online shopping space.

Additionally, Amazon has acquired central London retail space in a bid to set up its first cashierless store outside of the United States.

Amazon is planning to establish a new distribution center in Brazil, which will mark its second such facility in that country. Also, it recently rolled out Prime Subscription services in Brazil.

Furthermore, it plans to set up an infrastructure region in Indonesia, marking its ninth such establishment in the Asia Pacific (APAC) region, which is noteworthy.

Amazon’s increasing global presence is likely to continue driving its business growth in the near term.

Zacks Rank & Stocks to Consider

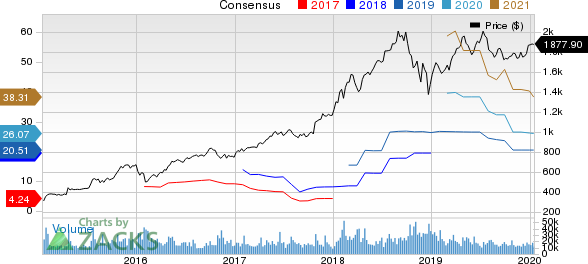

Currently, Amazon carries a Zacks Rank #3 (Hold).

Some better-ranked stocks in the retail-wholesale sector are Zumiez ZUMZ, Boot Barn Holdings BOOT and Walmart WMT. While Zumiez sports a Zacks Rank #1 (Strong Buy), Boot Barn and Walmart carry a Zacks Rank #2 (Buy). You can see the complete list of today’s Zacks #1 Rank stocks here.

Long-term earnings growth rate for Zumiez, Boot Barn and Walmart is pegged at 12%, 17% and 4.95%, respectively.

7 Best Stocks for the Next 30 Days

Just released: Experts distill 7 elite stocks from the current list of 220 Zacks Rank #1 Strong Buys. They deem these tickers “Most Likely for Early Price Pops.”

Since 1988, the full list has beaten the market more than 2X over with an average gain of +24.6% per year. So be sure to give these hand-picked 7 your immediate attention.

See 7 handpicked stocks now >>

Click to get this free report Amazon.com, Inc. (AMZN) : Free Stock Analysis Report Zumiez Inc. (ZUMZ) : Free Stock Analysis Report Walmart Inc. (WMT) : Free Stock Analysis Report Boot Barn Holdings, Inc. (BOOT) : Free Stock Analysis Report To read this article on Zacks.com click here. Zacks Investment Research