4 Coal Stocks Worth a Look in a Low-Demand Hit Industry

The Zacks Coal industry stocks have been under tremendous stress due to concerns about the impact of rising emissions. Coal is gradually losing ground to natural gas and renewable energy. The outbreak of novel coronavirus and the resultant decline in commercial and industrial activities has further affected coal demand.

Decline in prices has been hurting profit levels of operators over the past few years. However, stocks like Warrior Met Coal, Inc. (HCC), having exposure in metallurgical coal, are well poised to benefit from any revival in met coal demand. Other coal stocks that are poised to benefit from gradual revival in demand are Peabody Energy (BTU), Ramaco Resources (METC), and Contura Energy, Inc. (CTRA).

About the Industry

The Zacks Coal industry comprises companies that are involved in the discovery and mining of coal. Depending on the deposit, coal is mined by either opencast or underground method. Coal is valued for its energy content and used worldwide to generate electricity, and in steel and cement manufacturing.

The U.S. Energy Information Administration (“EIA”) estimates U.S. recoverable coal reserves at about 253 billion short tons, of which about 58% is underground mineable coal. Given the current production rates, coal resources are likely to last many more years.

3 Trends Likely to Impact the Industry

Losing Ground to Clean Energy Sources: The United States-based coal companies are presently fighting a lost cause. Clean energy sources like natural gas and renewable energy are now being preferred over coal for their energy needs. Availability of cheap shale gas in the United States, technological advancement and incentives on usage of renewable energy continue to cut down the popularity of coal as a source of energy. The outbreak of novel coronavirus also adversely impacted demand for coal globally. The latest report from U.S. Energy Information Administration (“EIA”) forecasts 2020 coal consumption in the United States to fall to 475.1 million short tons (MMst), indicating 19.1% decline from 2019 levels of 587.3 MMst. Demand for electricity from industrial customers is expected to drop 11% in 2020 due to the coronavirus pandemic, while coal demand from electric power sector is expected to drop by nearly 20% in 2020.

COVID-19 Taking its Toll on Exports: Amid declining domestic consumption, coal exports have been aiding U.S. miners to gain some lost ground. However, the outbreak of novel coronavirus and implementation of various degrees of lockdown had an adverse impact on industrial and commercial activities across the globe. Per EIA, coal export is expected to decline through 2020. Lower coal demand from India, Japan and Egypt due to the ongoing lockdowns will hurt U.S.-based coal producers. Weak demand from the Atlantic market is also making matters worse for U.S. coal producers. Coal exports are expected to drop to 61.3 MMst in 2020 from 92.9 MMst exported in 2019. No doubt the expected decline in coal exports volumes will adversely impact coal miners’ prospects in the United States.

Revival in Demand and Favorable Rule: A recent EIA release predicts coal production to increase by 17% from expected 2020 levels to 600 MMst in 2021. This projection takes into consideration rising demand for coal amid U.S. electricity generators because of higher natural gas prices compared with 2020. Moreover, the U.S. Environmental Protection Agency (“EPA”) announced final revisions to guidelines and standards for “steam electric” power plants. The 2020 Steam Electric Reconsideration Rule will aid the coal industry. Per the new rule, coal fired power plants that discharge bottom ash transport water or flue gas desulfurization wastewater may incur compliance costs under the 2020 final rule. EPA estimates 75 plants may incur compliance costs under the final rule, in an industry population of 914 plants. We expect this development to aid the coal industry and create fresh domestic demand for coal going forward.

Zacks Industry Rank Indicates Tough Times Ahead

The Zacks Coal industry is a 12-stock group within the broader Zacks Oil and Energy sector. The industry currently carries a Zacks Industry Rank #196, which places it in the bottom 22% of more than 250 Zacks industries.

The group’s Zacks Industry Rank, which is basically the average of the Zacks Rank of all the member stocks, indicates weak performance in the near term. Our research shows that the top 50% of the Zacks-ranked industries outperforms the bottom 50% by a factor of more than 2 to 1.

The industry’s position in the bottom 22% of the Zacks-ranked industries is a result of negative earnings outlook for the constituent companies in aggregate. Looking at the aggregate earnings estimate revisions, it appears that analysts are gradually losing confidence in this group’s earnings growth potential. Since September 2019, the industry’s earnings estimate for 2020 has gone down by 213.3%.

Before we present a few coal stocks that you may want to consider, let’s take a look at the industry’s recent stock-market performance and valuation picture.

Industry Lags S&P 500 & Sector

The Zacks Coal industry has underperformed the Zacks S&P 500 composite and the Zacks Oil and Gas sector over the past 12 months.

The stocks in the coal industry have collectively declined 52.3% compared with the Zacks Oil-Energy sector’s decrease of 42.2%. In contrast, the Zacks S&P 500 composite has risen 12.8%.

One Year Price Performance

Coal Industry’s Current Valuation

Since coal companies have a lot of debt on their balance sheet, it makes sense to value them based on the EV/EBITDA (Enterprise Value/ Earnings before Interest Tax Depreciation and Amortization) ratio.

The industry is currently trading at trailing 12-month EV/EBITDA of 5.25X compared with the Zacks S&P 500 composite’s 14.52X and the sector’s 4X.

Over the past five years, the industry has traded as high as 5.58X, as low as 2.73X and at the median of 4.12X.

Enterprise Value-to EBITDA (EV/EBITDA) Ratio vs S&P 500

Enterprise Value-to EBITDA (EV/EBITDA) Ratio vs Sector

4 Coal Industry Stocks to Keep a Close Watch On

Warrior Met: Brookwood, AL-based Warrior Met Coal produces and exports metallurgical coal for steel industry. The company deals with very high-quality coal and its revenues are primarily derived from the sale of premium met coal in the global seaborne markets. The company also enjoys a significant logistical cost advantage to the seaborne market as its high quality coal mines are located nearer to the port compared with its peers. Its highly flexible cost structure lowers its cash cost of sales if realized price falls, while being effectively capped in higher price environments allowing the company to generate significant operating cash flow.

The Zacks Consensus Estimate for Warrior Met Coal’s 2021 earnings and revenues suggests a year-over-year rise of 157.1% and 26.9%, respectively. Over the past 60 days, this company has seen the Zacks Consensus Estimate for 2021 go up by 0.5%. The stock has gained 17.9% over the past three months. Warrior Met Coal currently has a Zacks Rank #3 (Hold). You can see the complete list of today’s Zacks #1 Rank (Strong Buy) stocks here.

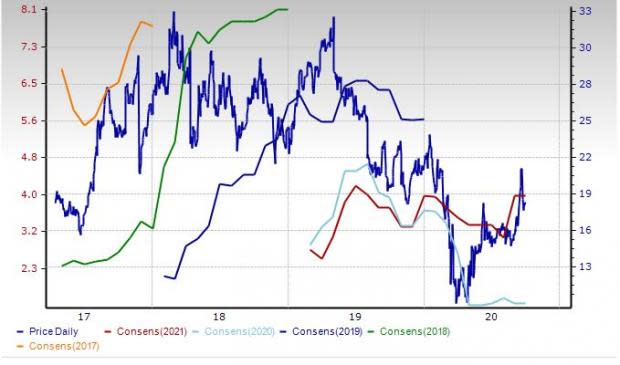

Price and Consensus: HCC

Peabody Energy: St Louis, MO-based Peabody Energy, having a Zacks Rank of 3, engages in the coal mining business and has both thermal and metallurgical coal operations. Nearly 33% of its revenues in 2019 were derived from five customers and with them the company still has 43 coal supply agreements (excluding trading and brokerage transactions) expiring at various times from 2020 to 2025, which assures a steady flow of revenues.

The Zacks Consensus Estimate for Peabody Energy’s 2021 earnings and revenues suggests a year-over-year rise of 96.1% and 13.8%, respectively. Over the past 60 days, this company has seen the Zacks Consensus Estimate for 2021 go up by 72.7%. The stock has gained 8.3% over the past three months.

Price and Consensus: BTU

Ramaco Resources: Lexington, KY-based Ramaco Resources is a Zacks Rank 3 stock. The company produces and sells metallurgical coal. The company has in excess of 265 million tons of high quality coal reserves and is well positioned to sell coal to domestic as well as international markets. Its low debt and minimal legacy liabilities provides it financial flexibility. The company supplies substantial volume of high quality met coal to domestic steel companies. The company is well poised to benefit from revival of domestic met coal demand as U.S. steel capacity utilization is increasing after demand destruction due to COVID-19 concerns.

The Zacks Consensus Estimate for its earnings and revenues points to a year-over-year rise of 716.7% and 34.5%, respectively. Over the past 90 days, this company has seen the Zacks Consensus Estimate for 2021 go up by 2.8%. The stock has gained 56.5% over the past three months.

Price and Consensus: METC

Contura Energy: Bristol, TN-based Contura Energy, Inc. extracts, processes, and markets metallurgical as well as thermal coal to electric utilities, steel and coke producers, along with industrial customers in the United States. The company has substantial coal reserves and can produce coal from its assets in two major U.S. coal producing basins. In addition, it also owns a 65% interest in Dominion Terminal Associates (“DTA”), a coal export terminal in eastern Virginia. DTA provides the company with the ability to fulfill a broad range of customer coal quality requirements through coal blending while also providing storage capacity and transportation flexibility. It has a Zacks Rank of 3.

The Zacks Consensus Estimate for its 2021 earnings and revenues indicates a year-over-year rise of 111.4% and 26.8%, respectively. Over the past 60 days, this company has seen the Zacks Consensus Estimate for 2021 go up by 10.8%. The stock has gained 168.4% over the past three months.

Price and Consensus: CTRA

More Stock News: This Is Bigger than the iPhone!

It could become the mother of all technological revolutions. Apple sold a mere 1 billion iPhones in 10 years but a new breakthrough is expected to generate more than 27 billion devices in just 3 years, creating a $1.7 trillion market.

Zacks has just released a Special Report that spotlights this fast-emerging phenomenon and 6 tickers for taking advantage of it. If you don't buy now, you may kick yourself in 2021.

Click here for the 6 trades >>

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

RAMACO RESOURCS (METC) : Free Stock Analysis Report

Warrior Met Coal Inc. (HCC) : Free Stock Analysis Report

CONTURA ENERGY (CTRA) : Free Stock Analysis Report

Peabody Energy Corporation (BTU) : Free Stock Analysis Report

To read this article on Zacks.com click here.

Zacks Investment Research