3 Top Picks From The Thriving Waste Management Industry

It doesn’t matter that we are amid a pandemic that is unlikely to dissipate any time soon, we cannot stop producing waste. The waste management industry is, thus, in a good shape, witnessing a relative shift of waste production from industry and commercial centers to medical centers and residential areas.

The coronavirus pandemic has strongly necessitated the proper disposal of trash. Hence, waste management companies are at an advantage as there has been a substantial increase in residential waste with the rise in the work-from-home trend and travel restrictions. Medical waste, too, has increased due to the rising usage of masks, gloves, suits and syringes.

Increasing population and urbanization are key drivers of the industry, as these prompt a significant rise in garbage and recycling. Also, decline in places to store or dump garbage, with the landfills being filled and closed, is considerably fueling the need to manage waste. Environmental awareness is also another crucial growth driver as awareness regarding renewable waste-management systems and concerns regarding the spike in CO2 emissions are heightening with rapid industrialization.

From Investment Point of View

Garbage production continues, irrespective of the economic condition, keeping demand for waste management services fairly stable through the fluctuating economic cycle. Increased technology adoption is turning out to be a big positive for the industry’s bottom line.

According to Allied Market Research, the global waste management market size is anticipated to reach $2,339.8 billion by 2027 from $2,080 billion in 2019, at a CAGR of 5.5% from 2020 to 2027.

Clean-up companies generate stable revenues and cash flows from customers across diverse industries and pay out stable dividends. This makes waste management stocks robust defensive players.

Stocks to Buy Now

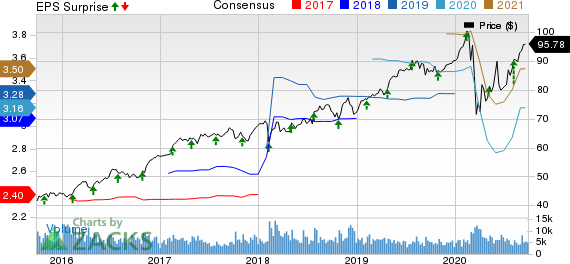

Non-hazardous solid waste collection, transfer, disposal, recycling, and environmental services provider Republic Services RSG currently flaunts a Zacks Rank #1 (Strong Buy). You can see the complete list of today’s Zacks #1 Rank stocks here.

The company’s shares have gained 22.7% over the past six months. Estimates for the ongoing year moved 12.1% north in the past two months.

Though the company’s earnings are likely to be down 5.4% in 2020 due to the pandemic-induced significant reduction in service levels, the figure is anticipated to be up 10.9% next year with the resumption of operations. The company will benefit from continued investments in operational efficiency and enhancement of customer experience in the days to come.

Acquisitions are Republic Services’ favorite mode of fortifying its market position and boosting cash. The company has already invested $124 million, which will likely grow to $600-$650 million by the end of this year.

Republic Services, Inc. Price, Consensus and EPS Surprise

Republic Services, Inc. price-consensus-eps-surprise-chart | Republic Services, Inc. Quote

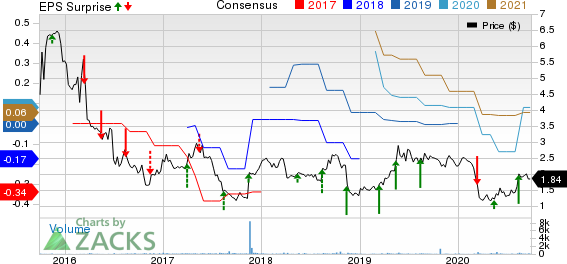

Lead recycler Aqua Metals AQMS carries a Zacks Rank #2 (Buy), at present. The company’s shares have rallied a massive 96.6% over the past six months. For the current year, the bottom line is expected to surge 67.4%. Estimates for the ongoing year have been revised 6.7% upward in the past two months.

Aqua Metals is currently focusing on market development and technology improvement initiatives aggressively. The company is anticipated to enhance its cash position through sale of unnecessary assets in the upcoming period.

Aqua Metals, Inc. Price, Consensus and EPS Surprise

Aqua Metals, Inc. price-consensus-eps-surprise-chart | Aqua Metals, Inc. Quote

Quest Resource Holding Corporation QRHC also carries a Zacks Rank #2, currently. The company’s shares have appreciated 58.6% over the past six months. The earnings estimate for 2020 has moved up more than 100% in two months’ time.

Quest’s asset-light business model is enabling it to align costs with the current level of business. The company continues to add programs with current customers and has a robust pipeline of new consumer opportunities. It has diverse end markets and is actively pursuing its M&A strategy.

Quest Resource Holding Corporation. Price, Consensus and EPS Surprise

Quest Resource Holding Corporation. price-consensus-eps-surprise-chart | Quest Resource Holding Corporation. Quote

More Stock News: This Is Bigger than the iPhone!

It could become the mother of all technological revolutions. Apple sold a mere 1 billion iPhones in 10 years but a new breakthrough is expected to generate more than 27 billion devices in just 3 years, creating a $1.7 trillion market.

Zacks has just released a Special Report that spotlights this fast-emerging phenomenon and 6 tickers for taking advantage of it. If you don't buy now, you may kick yourself in 2021.

Click here for the 6 trades >>

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

Republic Services, Inc. (RSG) : Free Stock Analysis Report

Quest Resource Holding Corporation. (QRHC) : Free Stock Analysis Report

Aqua Metals, Inc. (AQMS) : Free Stock Analysis Report

To read this article on Zacks.com click here.

Zacks Investment Research