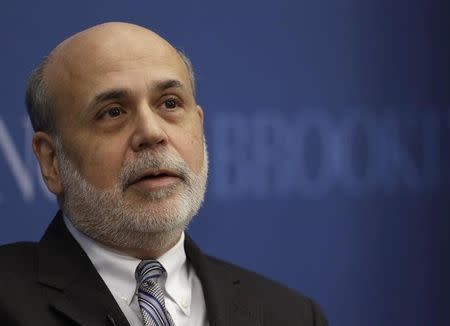

Former Fed Chair Bernanke takes stand in AIG bailout trial

By Aruna Viswanatha

WASHINGTON (Reuters) - Former Federal Reserve Chairman Ben Bernanke took the stand on Thursday to defend the U.S. government's bailout of American International Group in 2008, describing how policymakers sought to avoid giving AIG shareholders a "windfall" through a rescue.

Bernanke's comments came in a fourth day of testimony by former top government officials looking to convince a federal judge that the rescue of the insurance company was legal.

On Thursday afternoon, Bernanke distinguished between the $85 billion loan package provided to AIG, which came with an interest rate of more than 12 percent and a nearly 80 percent stake in the company, and loans the government provided to banks at the height of the 2007-2009 financial crisis through broad lending facilities at the New York Fed.

While officials designed the AIG rescue to "minimize windfall" for shareholders, they considered countervailing factors when designing the other programs, including the need to get the funds into the financial system and avoid any stigma associated with taking advantage of the loans, Bernanke said.

Former AIG Chief Executive Hank Greenberg, who was also the company's largest shareholder, sued the government in 2011 over the terms of the bailout's loan, arguing they amounted to an illegal taking of the company from AIG shareholders.

Government lawyers have countered that the bailout in the end raised the value of AIG shares and that policymakers had to consider "moral hazard" concerns when calculating its terms.

To make their case, Greenberg's lawyers have tried to portray the government as singling out AIG shareholders for punishment, without having a basis for doing so. They have also pushed officials to confirm that the situation was so dire that the government would have moved to save AIG even if the company had refused the initial offer.

When asked on Thursday by Greenberg's lawyer, David Boies, if officials had concluded that AIG's collapse could have catastrophic consequences for the broader financial system, Bernanke responded: "We were very concerned about that possibility, yes."

Bernanke also testified that he did not know, at the time the loan terms were drafted, what the exact basis was for the interest rate or other fees added to the loan were.

His testimony is expected to continue on Friday.

Earlier on Thursday, former U.S. Treasury Secretary Timothy Geithner wrapped up two and one-half days on the stand, sparring with Boies over whether the loan posed substantial risks to the government.

Boies has sought to portray the New York Federal Reserve bank, which Geithner led at the time, as making AIG a low-risk loan with undeservedly high terms.

A Justice Department lawyer, Kenneth Dintzer, on Thursday introduced previous statements in which Geithner had expressed worries that American taxpayers faced the risk of "substantial losses" through the AIG bailout.

Just before wrapping up his questioning of Geithner, Boies asked Geithner about his impression of Greenberg, who had argued that AIG's insurance businesses were highly valuable and said that he had been refused a seat at the table during the AIG bailout negotiations.

"I found his confidence and optimism, uh, unique," Geithner said.

AIG finished repaying the full $182.3 billion bailout in December 2012, leaving taxpayers with a nearly $23 billion profit.

The lawsuit, which is being tried in the Court of Federal Claims in Washington, won class action status in May 2013.

The case is Starr International Co v. U.S., U.S. Court of Federal Claims, No. 11-00779

(Reporting by Aruna Viswanatha; Editing by Steve Orlofsky)